10 Healthcare Payment Trends in 2022

It can be difficult to keep up with the latest healthcare payment trends in a rapidly changing landscape. Here are 10 predictions for what we’ll see in 2022. From new technology like artificial intelligence to an increase in value-based care, these healthcare payment trends will have a major impact on the industry.

Trend #1: The Rise of Digital Health

More and more healthcare providers are moving towards digital health. This trend benefits both patients and providers.

With digital health, patients can save time and money. Virtual visits help patients avoid having to take time off work or school. They can also access their health information online, schedule appointments, and manage bills. When it comes to digital payment options, a recent Instamed study showed that 91% of consumers prefer an electronic payment method for their medical bills.

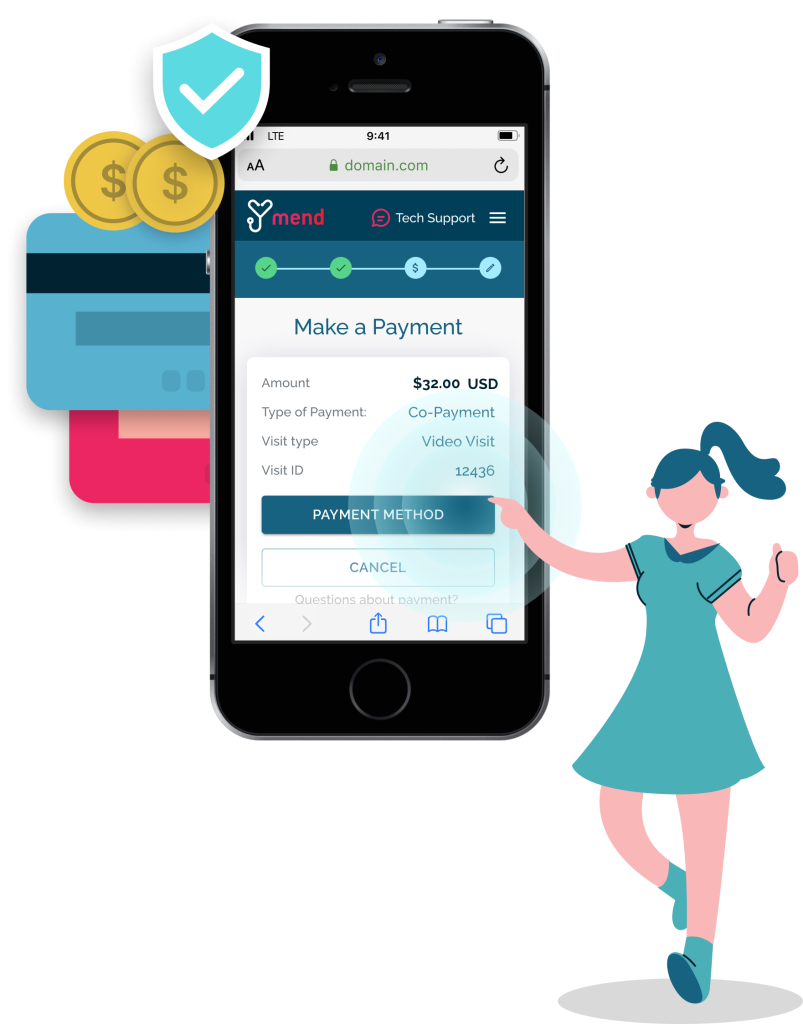

With telemedicine solutions like Mend, providers can benefit from a seamless digital solution. Digital intake forms and automated payment processing reduce costs associated with office space, paper resources, and administrative staff.

Trend #2: AI for Healthcare Payment Processing

The growth of artificial intelligence (AI) in healthcare is changing how organizations process payments. For example, many utilize AI to create more efficient and accurate claims processing. It can also detect fraud in healthcare payments.

Mend can also create automated payment processing flows to decrease the workload on administrative staff. Patient responsibilities such as co-pays are collected automatically before or after an encounter. Then, they are recorded in the payment management system. Learn more in our eBook: How to Automate Patient Payments Before & After the Visit.

Trend #3: Increased Need for Digital Healthcare Payment Solutions

The rise of telehealth has been one of the biggest impacts on healthcare payment trends in recent years, resulting in a need for more digital payment solutions. With the patient being remote, swiping a card for payment is no longer possible.

Research shows that even after the pandemic subsides, patients still want digital payment solutions. In that same InstaMed Annual report, sixty-five percent of consumers want to keep using virtual and self-service options. This makes a robust payment processing system not only convenient but necessary.

Trend #4: The Increasing Importance of Patient Engagement

As healthcare costs rise, patients are looking for ways to reduce expenses. One way to do this is by becoming more engaged in their own care. Engaged patients are more likely to make healthy lifestyle choices, adhere to treatment plans, and avoid unnecessary hospital visits.

Healthcare organizations are starting to recognize the importance of patient engagement while taking steps to encourage it. Patient portals are an example of this.

How an organization collects payment is also a critical element of patient engagement. At Mend, we’ve found that when patients have the option to pay for their appointment ahead of their visit, they are far more likely to attend and actively engage in their care.

Trend #5: Consumerization of Healthcare

In recent years, patients have been paying more out of pocket for their own care. Because of this, they want to be viewed as customers. In fact, sixty percent of consumers expect their digital healthcare experience to mirror that of retail.

Retail experiences like Amazon and Walmart are mobile, fast, and ultra-convenient. Uber and Instacart make for effortless delivery or transportation services. Consumers are aware of these advancements in payment technology. Healthcare organizations that match the experiences of other industries will win in the future.

Trend #6: Storing Digital Payment Methods

With services like Apple Pay, consumers are more comfortable using digital cards for retail payment. This same ease of payment proves a beneficial trend to the healthcare industry as well. For example, if a patient consents to store their payment information digitally, they can pay medical bills in just a few clicks.

This frictionless payment option is also a win for providers. Seventy-three percent of physicians say it typically takes at least one month to collect payments from patients, with 12% of patients waiting more than three months to pay. The storage of digital payments can result in higher percentages of payment and a faster collection speed.

Trend #7: Preventative Care for Decreasing Costs

Preventative care is also an emerging trend, and there are a few reasons for this. Patients understand that it is cheaper to prevent a disease than treat it. People are becoming more aware of the importance of their health. They know that if they take care of themselves they will be less likely to get sick.

This trend toward preventative care is likely to continue in the future. As people become more health-conscious, they will be more likely to take steps to avoid getting sick. This will lead to lower healthcare costs and a healthier population.

Trend #8: Younger Generations are Demanding More

While a good portion of the population utilized telehealth during the pandemic, younger generations drive the demand for ongoing digital solutions. How an organization processes its payments is a large part of this.

In a recent report, patients aged 18 to 24 are three times as likely (61%) to consider switching providers over a poor digital experience.

Trend #9: Increase in Price Transparency

Another emerging healthcare payment trend surrounds price transparency. In the same InstaMed Annual report mentioned above, 9 in 10 consumers want to know their payment responsibility upfront.

Yet despite this desire, many patients still feel left in the dark. Negotiated rates, eligibility, and deductible amounts are just a few of the elements that cause uncertainty and confusion over final costs. Only 20% of patients always know what they will owe after an appointment. 61% of consumers said their providers did not ask about the affordability of healthcare and/or discuss resources to assist with costs.

Healthcare organizations that provide this information in a transparent manner will gain patient loyalty as well as improve overall satisfaction.

Trend #10: The Move Toward Value-Based Payments

The final trend is toward value-based payments in healthcare. This means that healthcare providers are paid based on the quality of care they provide rather than the number of services. This incentivizes providers to focus on quality over quantity.

Value-based payments are becoming more common as insurance companies move away from fee-for-service payments. In these arrangements, healthcare providers are paid for each service they provide, regardless of if the patient actually benefits from the service. This can lead to unnecessary tests or procedures, which drives up costs without improving outcomes.

Value-based payments help to address this issue by tying payment to outcomes. This approach will help control costs and result in better patient care.

Conclusion

The healthcare industry is constantly evolving, which means how we pay for healthcare services is also changing. We’ve looked at 10 of the most likely healthcare payment trends that we’ll see in 2022. From an increased focus on value-based care to the rise of mobile payments, it is clear that the healthcare industry is heading in a new and exciting direction.